Zoho Invoice is a free online invoicing software (with no ads, contract, or hidden fees) that helps you:

Zoho invoice can easily integrate with other business apps and access native invoice apps from any device.

If you use Zoho Invoice, you can tailor your invoices and send professional, good-looking invoices to your customers and get paid fast!

Zoho invoice allows you to:

If you want to send beautiful and professional invoices to your customers today, click here to start!

Apart from being free for life, Zoho Invoice also has these benefits:

You can capture all the adequate tax-related information and give your customers a neat breakdown of the exact taxes charged on them. All your invoices will remain compliant with Uk’s tax rules and layout requirements.

Your customers have a self-service portal where they can view their invoices, check estimates, make payments, and more.

You can track time and bill your clients for hours spent on their projects. Do this by starting the timer from your mobile, computer, or Apple Watch whenever you begin working—Zoho Invoice will log every billable minute in a clear calendar format.

Zoho Invoice Multi-lingual support feature lets you create invoices in each of your customers’ languages.

Just pick a template, choose the language you prefer and start invoicing right away!

Zoho Invoice enables you to map a template to every contact and allows you to personalise every step of the sales process.

Zoho invoice allows you to track your unbilled expenses until they are paid. You can also auto-scan your expense receipts and calculate your travel expenses based on GPS and mileage.

You can create and send invoices on the go using the Zoho Invoice mobile app built for IOS, windows and android.

With Zoho Invoice, you have the option to give discounts at item level or invoice level subject to your requirement. You can enable this option under Settings. You can also capture your shipping charges in your invoice.

Ensure that your customers agree with your prices before you start billing them by sending estimates- including quotes and discounts for your customers’ approval. You can convert them to projects or invoices once approved.

Zoho Invoice allows users to handle invoices in foreign currencies with decimal precision. Online payments are a breeze as well as Zoho Invoice lets customers pay using their gateway of choice. Users do not need to switch to another platform when on Zoho Invoice, as transactions and all operations related to it can be done there.

The review feature will give you a view of all vital business information, like best-selling products and services or customers who are prompt with their payments.

Zoho Invoice users can easily assign tasks to members as well as oversee their roles.

Zoho Invoice has the highest grade of data security, PCI-DSS compliance with 256-bit SSL encryption, two-factor authentication, regular intrusion/virus detection, and prevention scanning. Additionally, data retention is taken seriously, with users able to recover data anytime they need it. Automatic backups and data replication are also done frequently, so no information is lost.

Choose a template from the Zoho invoice gallery and customise it.

Create multilingual and multicurrency invoices.

Set recurring invoices– set up a recurring billing profile to automatically bill and charge your regular customers receiving periodic services or products.

Verify transactions before you send them. You can reduce the risk of processing incorrect transactions by validating and approving them before invoicing your customers.

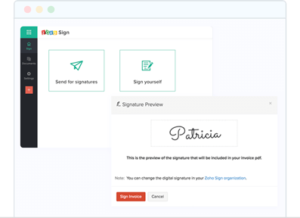

Sign your invoices- use your digital signature to prevent invoice forgery or tampering. The Zoho Sign integration ensures the highest level of security, compliant with ESIGN and eIDAS e-signature laws.

Print and share invoice with ease- sharing invoices using Zoho Invoices is easy because it allows you to create clones, print out a copy, or email them. You can also schedule emails for a later date and time or send out invoice links having expiration dates.

Manage refunds and returns with credit notes and apply them to your customer’s future sales.

Get real-time invoice reports: Run real-time reports on your sales, expenses, and tax summary. You can also schedule key reports and receive them automatically by email.

Zoho Invoice offers the following integrations:

Feel free to choose an invoice template of your choice and brand invoices for £0 by trying Zoho Invoice today. You don’t need your credit card details to sign up!