When you are trading as a sole trader, ending or leaving a business partnership, you must:

There are two ways you can use to notify HMRC when you stop self-employment. They include:

Please see this informative video guide how to go online and stop your Self Assessment if you're self-employed

This guide not only provides valuable information on how to deregister from self-assessment but also offers a step-by-step process for your convenience.

The process is broken down into the following easy-to-follow steps:

1.Start by logging in to HMRC's online services using your unique User ID and password

2.Head over to GOV.UK, search 'stop being self-employed' and choose the link shown on the image below,

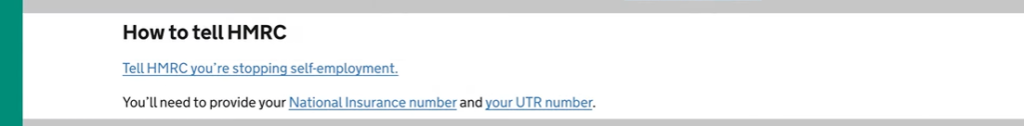

3.Then select the option 'tell HMRC you're stopping self-employment'

4. If you've logged in to your Government Gateway account recently, you'll be swiftly directed to your account page. However, if you haven't, you can still sign in by using your User ID and password."

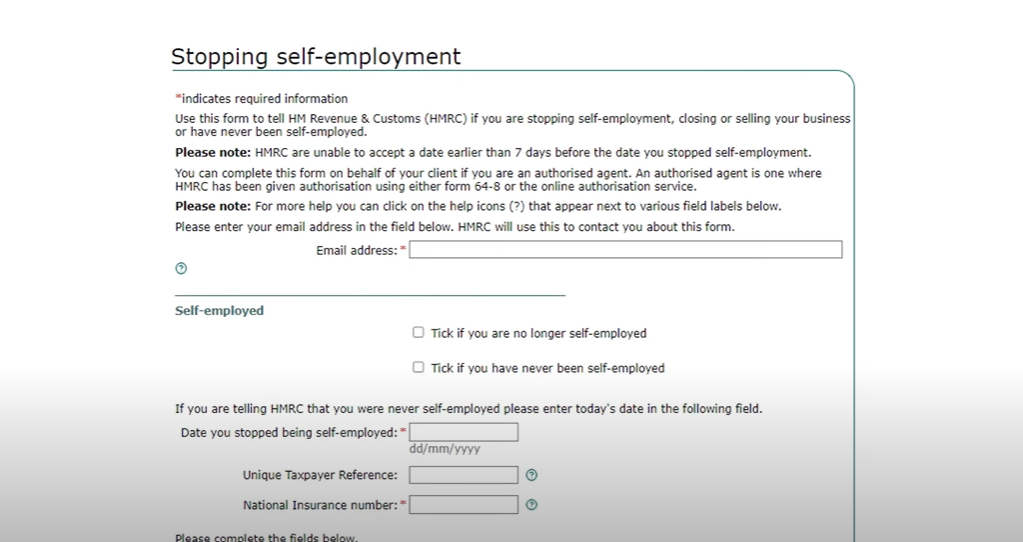

1. Completing the 'stopping the self-employment form'

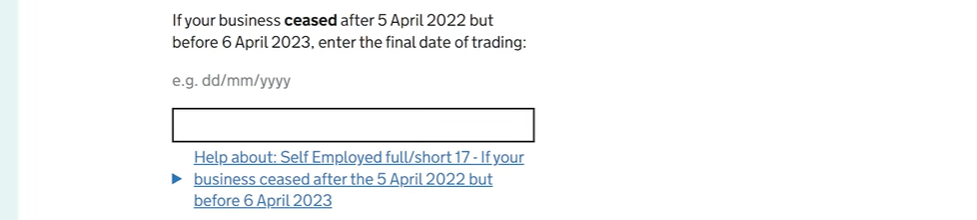

Please ensure that your address and contact details are accurate. The form includes helpful question marks, providing additional information about the questions you're being asked.

If you prefer, you can also have an accountant, bookkeeper or tax agent complete the form for you, making the process hassle-free. Spondoo Accountants are at your service.

2. Once you've filled in all the necessary information, select 'next'. This will take you to a summary sector where you can review your details and make necessary edits. If you're satisfied that all the details are correct, proceed by selecting 'Submit' at the bottom of the page.

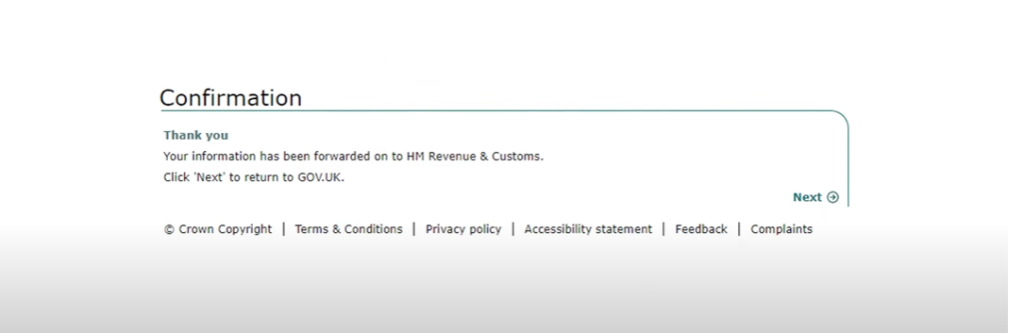

3. Voila! You're all done. Below is the confirmation image that will indicate that submission has been sent.

Please note: To fill the form, you will need your UTR number and national insurance number.

We strongly recommend opting for the convenience of completing the online form. Not only is it a quicker method compared to posting information or making a phone call to HMRC, but it also helps you navigate the process effortlessly.

Following this straightforward process, HMRC will contact you if they require any additional information or have further questions.

If you do not inform HMRC you have stopped being self-employed (after you have stopped trading), HMRC will continue sending you self-assessment tax returns. If you ignore these returns you will be liable for late filing penalties.

Additionally, HMRC may create an estimated tax bill if you do not complete and submit the tax returns on time. These estimated debts are legally due and can only get displaced by sending in a tax return within three years of the filing date for the return.

When you send the final return, you must:

Contact an accountant to get help with your tax return now!

If your partnership is ending, the nominated partner should send a final Partnership Tax Return by the deadline.

Yes, you can reduce your final tax bill by claiming:

Depending on your case, you must do the following:

Remember to cancel your VAT registration if you or your partnership are registered.

If you're VAT registered, visit GOV.UK and search 'cancel your VAT registration' to follow the necessary steps.

Please ensure to complete your final tax return and make any payments owed.

Remember that the deregistration form will require you to add the date you officially want to stop self-employment. Nonetheless, HMRC cannot accept a date earlier than seven days before the date you stopped being self-employed.

Close your PAYE scheme and send final payroll reports to HMRC if you stop employing staff.

If you have employees, ensure that you close your PAYE scheme appropriately.

You will be liable for your business debts. Your creditors can take you to a court or make you bankrupt if you do not pay.

However, you might be able to find an alternative payment option- like an Individual Voluntary Agreement.

If you're in the CIS, be sure to contact and inform HMRC separately regarding your status.

Call the CIS helpline as soon as possible if you are registered and stop trading as a contractor or subcontractor.

Once you deregister from Self-assessment, HMRC will:

Contrarily, you should:

For more detailed information and guidance, please visit GOV.UK

Our self-assessment team can help by:

Contact us now for your self-assessment needs.