Restrict access - Zoho Books users and roles

As the admin of your Zoho organisation, you can assign users in your organisation different roles and limit what they can access. This article explains how.

How to limit access of users in Zoho Books

You can limit what your employees can access in Zoho Books by creating something called a Role where you can assign granular level permissions to this new user type.

Creating a Role in Zoho Books

To create a new role in Zoho Books, follow the following steps:

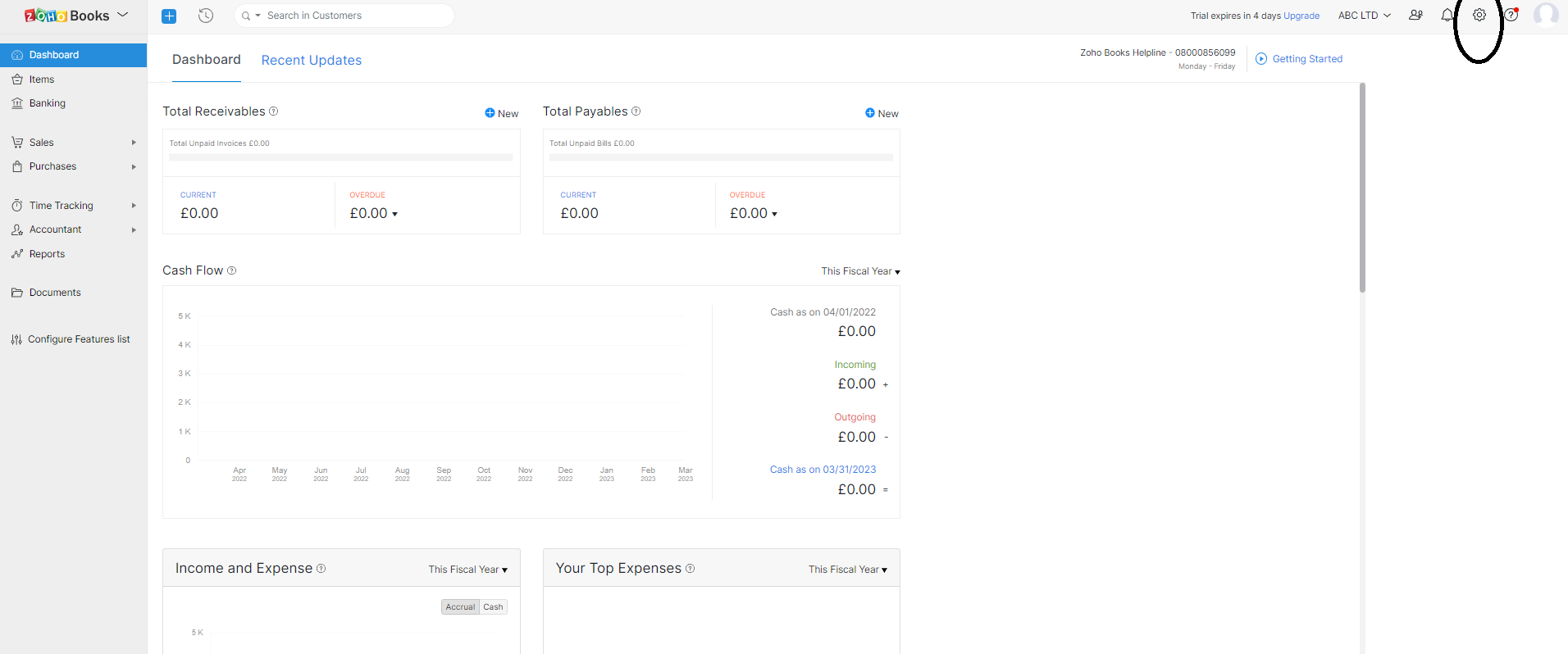

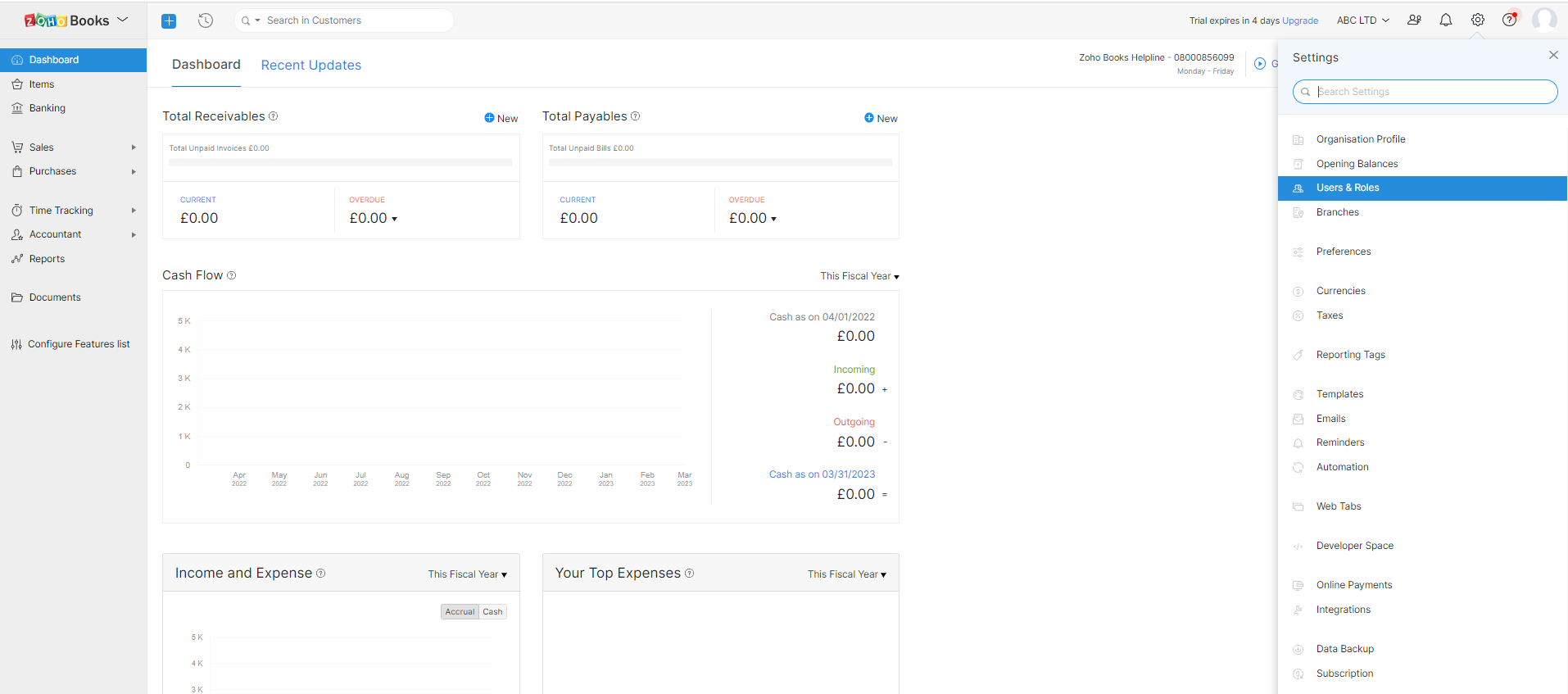

- From the Zoho Books dashboard, click on the settings icon.

- Select Users & roles from the drop-down menu.

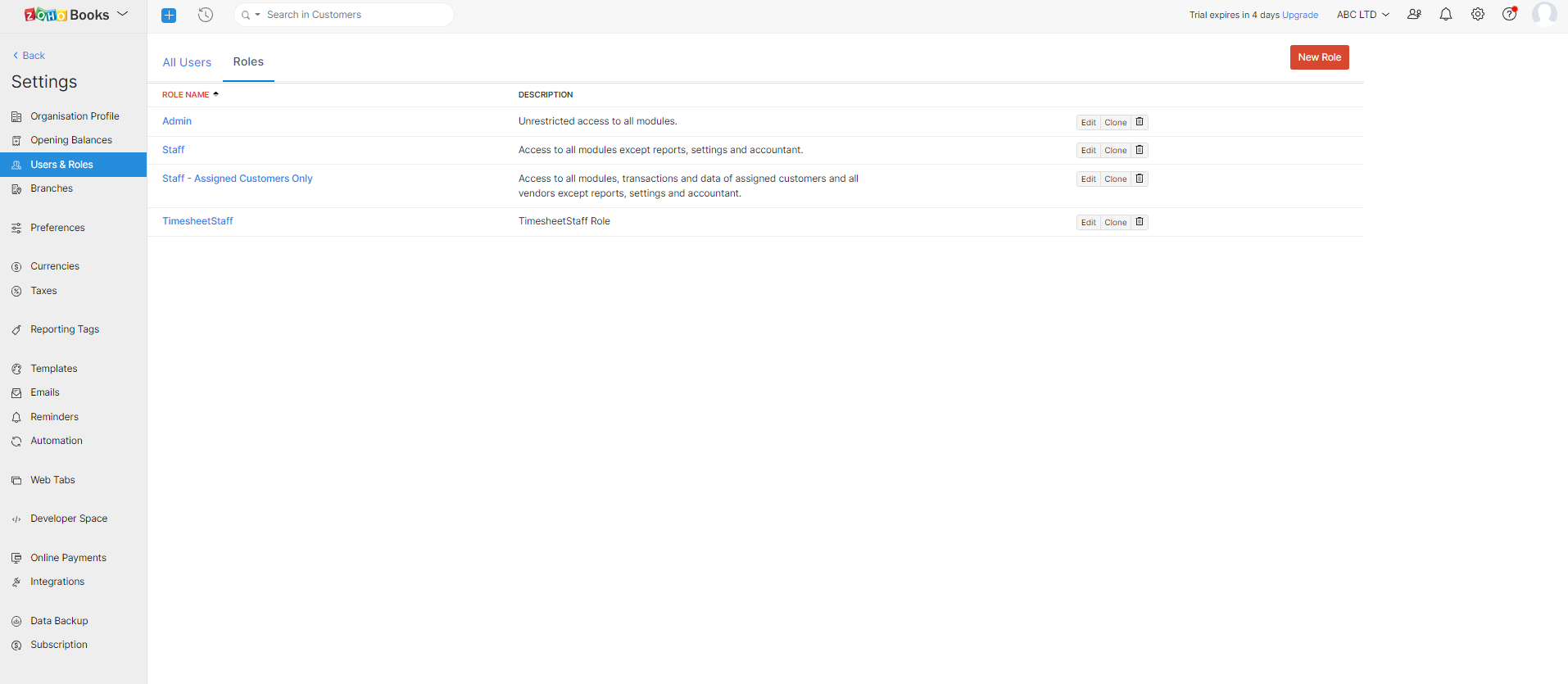

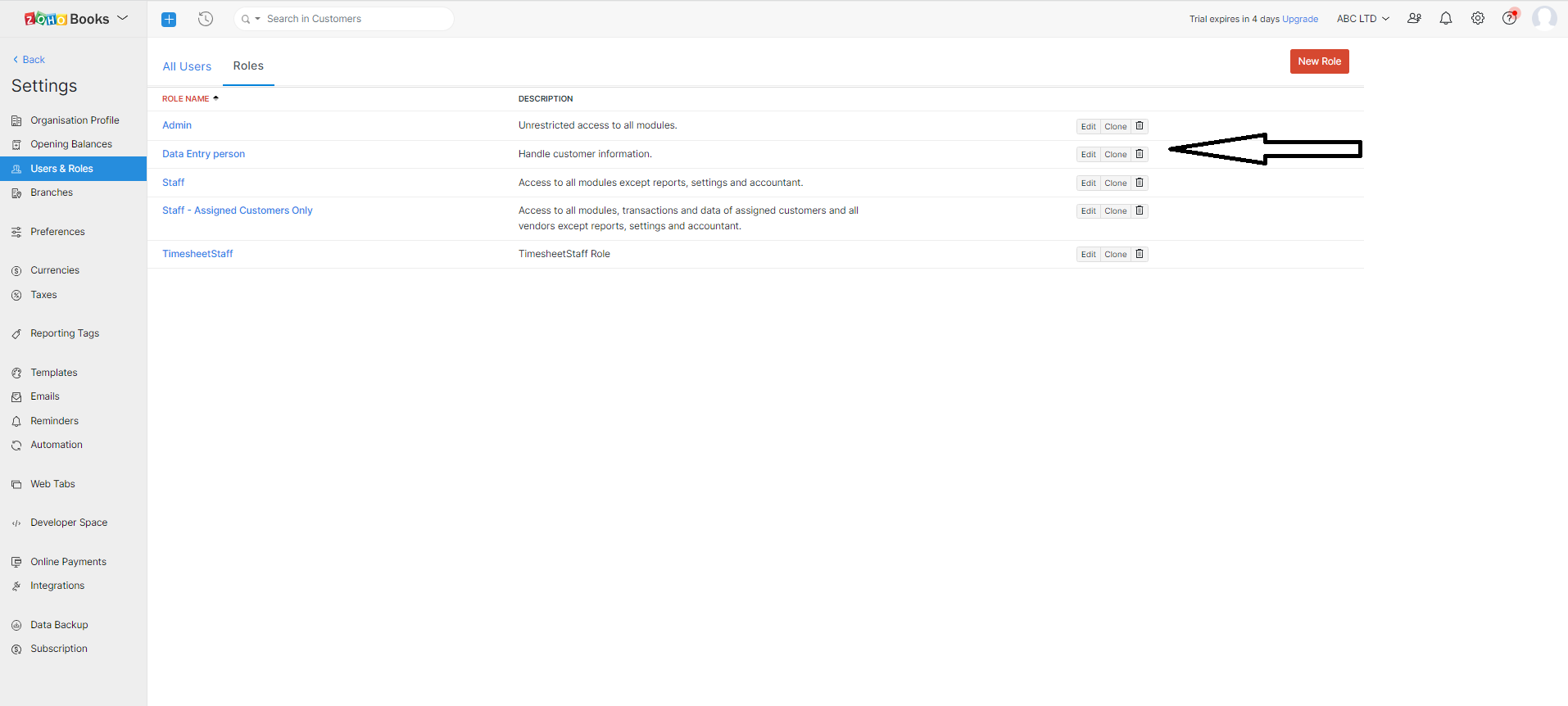

- Choose Roles. You will see Zoho Books has predefined roles already set up.

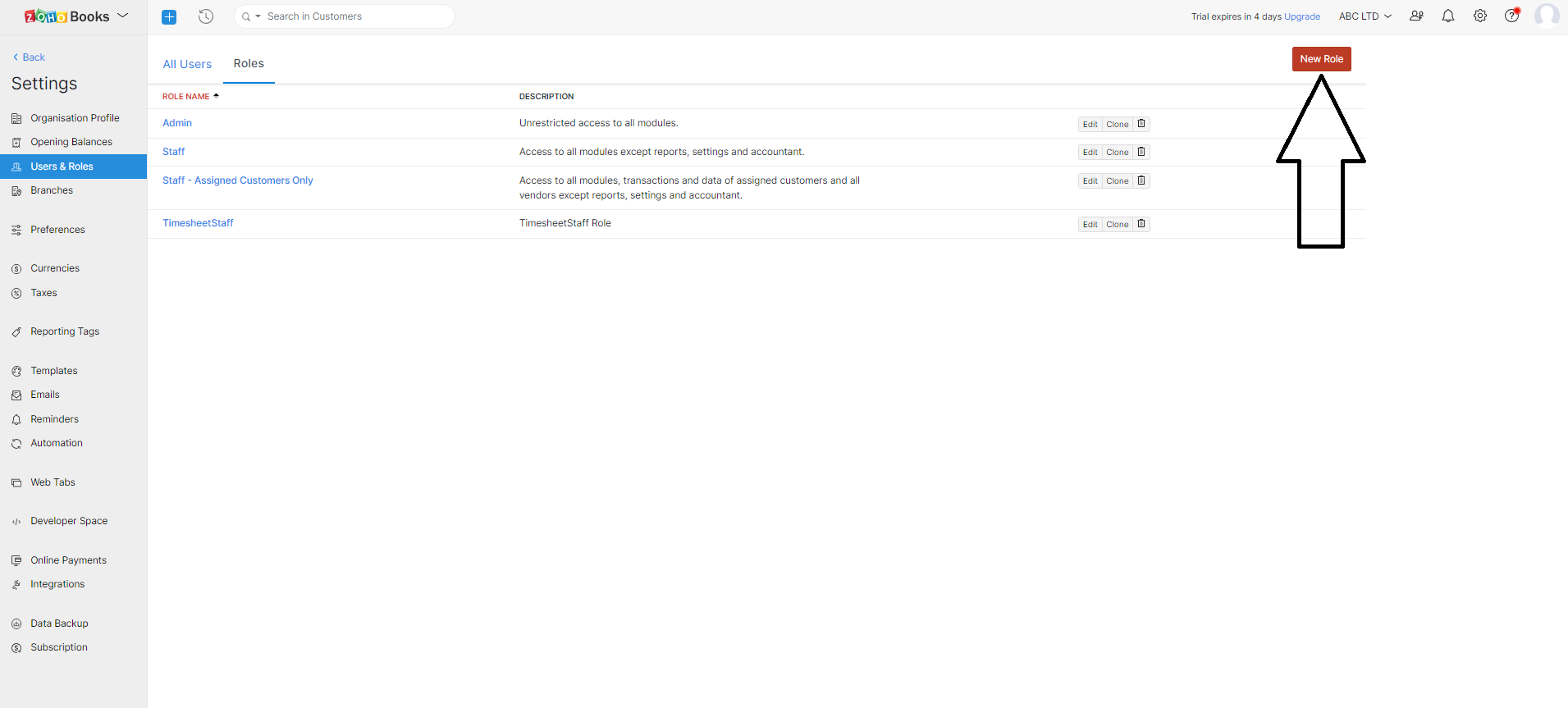

- Click the New Role button.

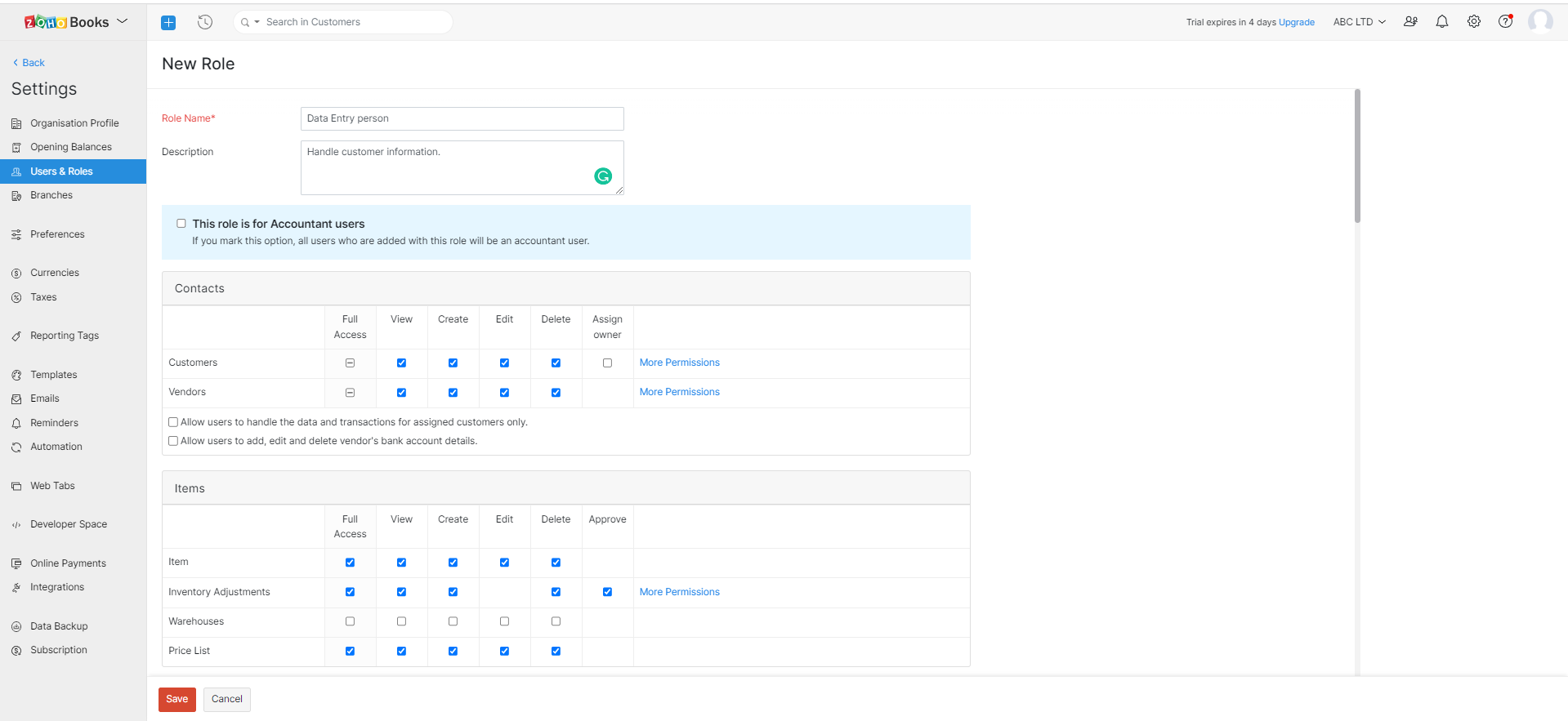

- Zoho Books allows you to name a new role and select the modules (Contacts, Items, Banking, Sales, Purchases, Accountant and Timesheet) and the level of access you want to provide for the role.

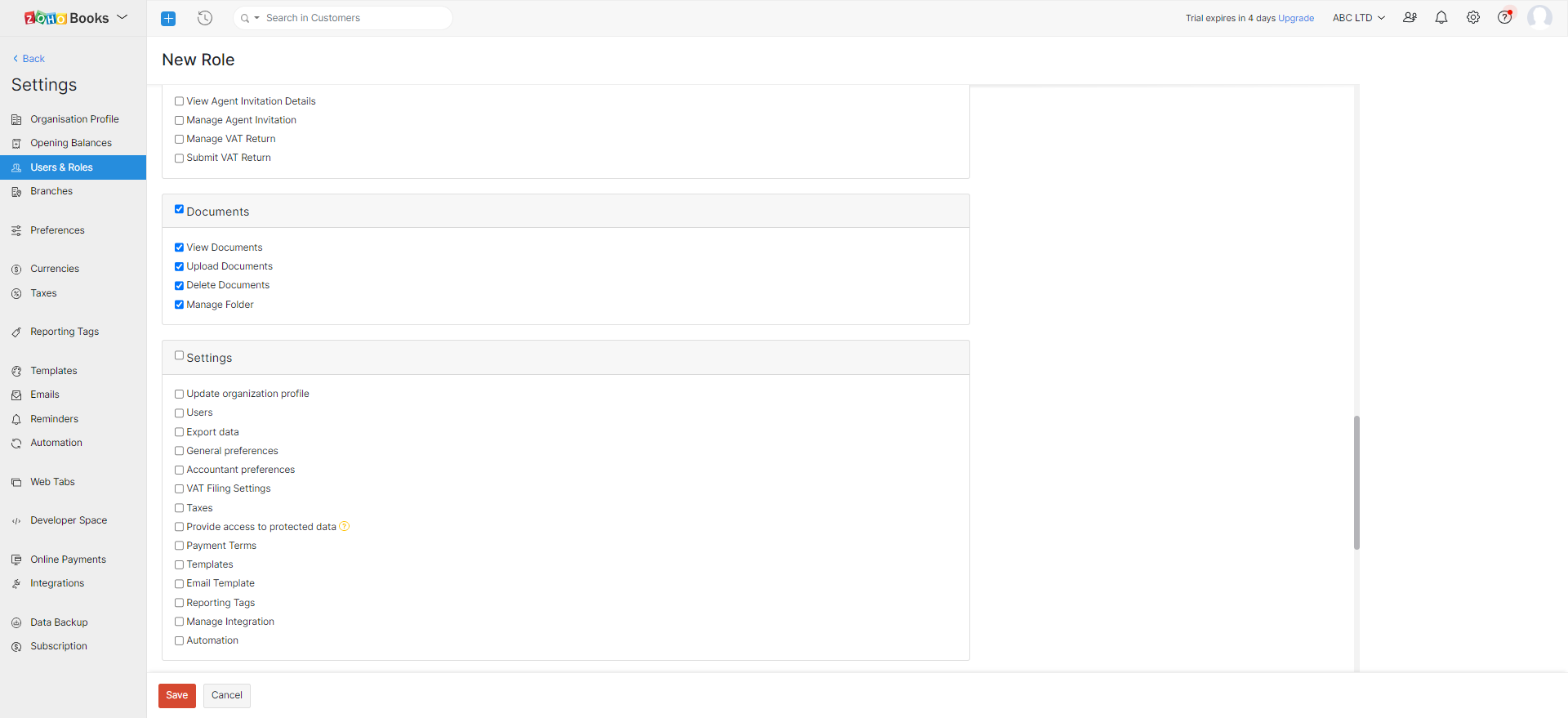

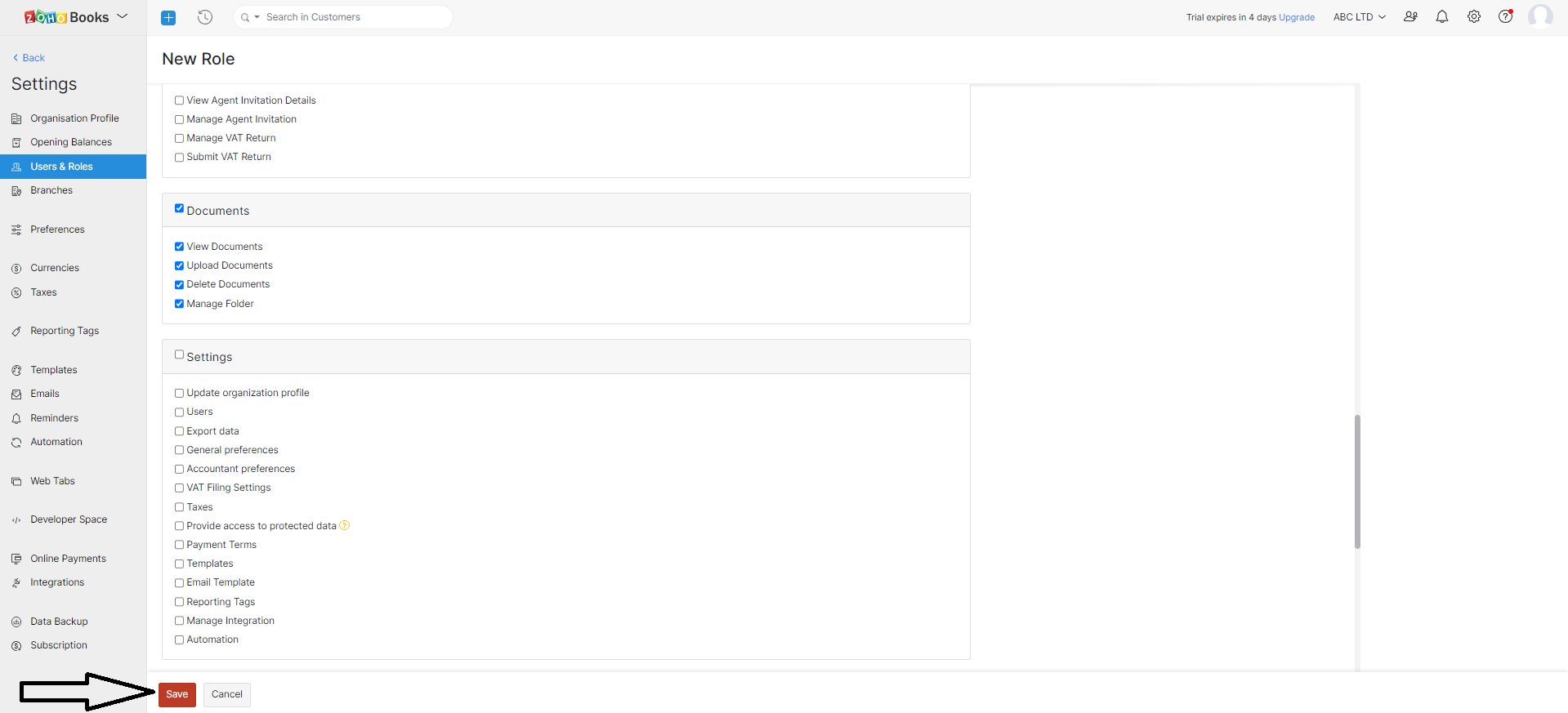

- You may find more permissions (VAT filing, Documents, Settings and Dashboard) at the bottom of the screen.

Your new role will be set up and will appear under Roles.

Assigning a user a Role in Zoho Books

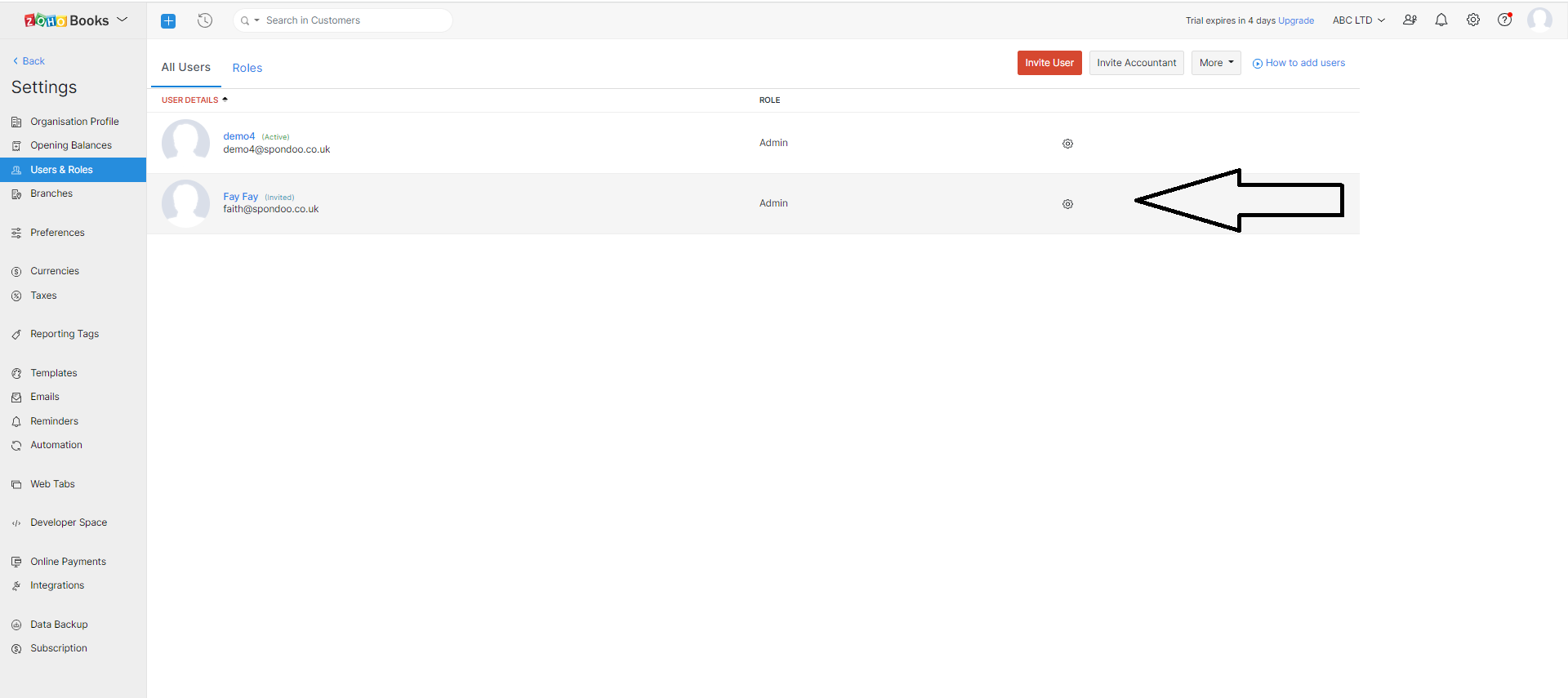

If you want to assign a user a Role, go to Settings > Users and roles > User. You can then:

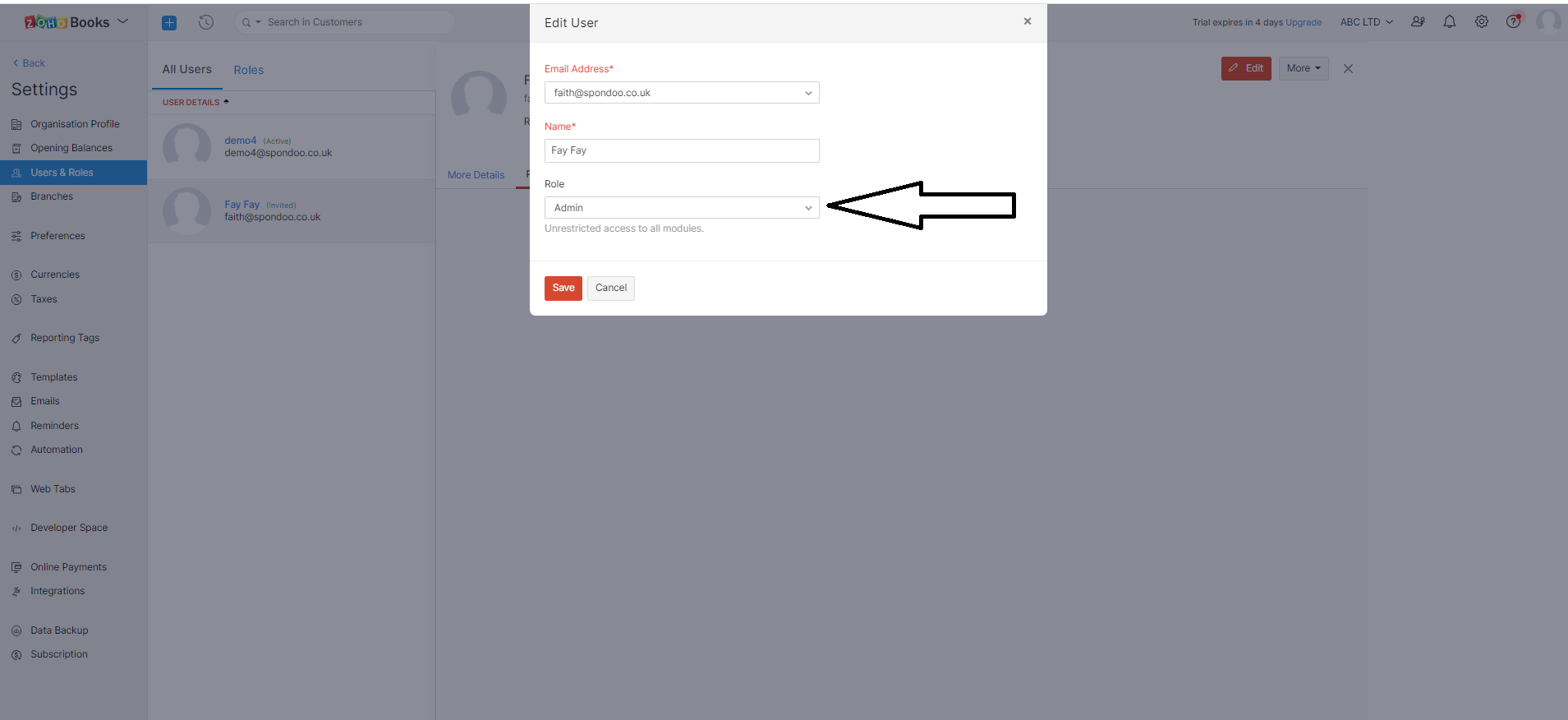

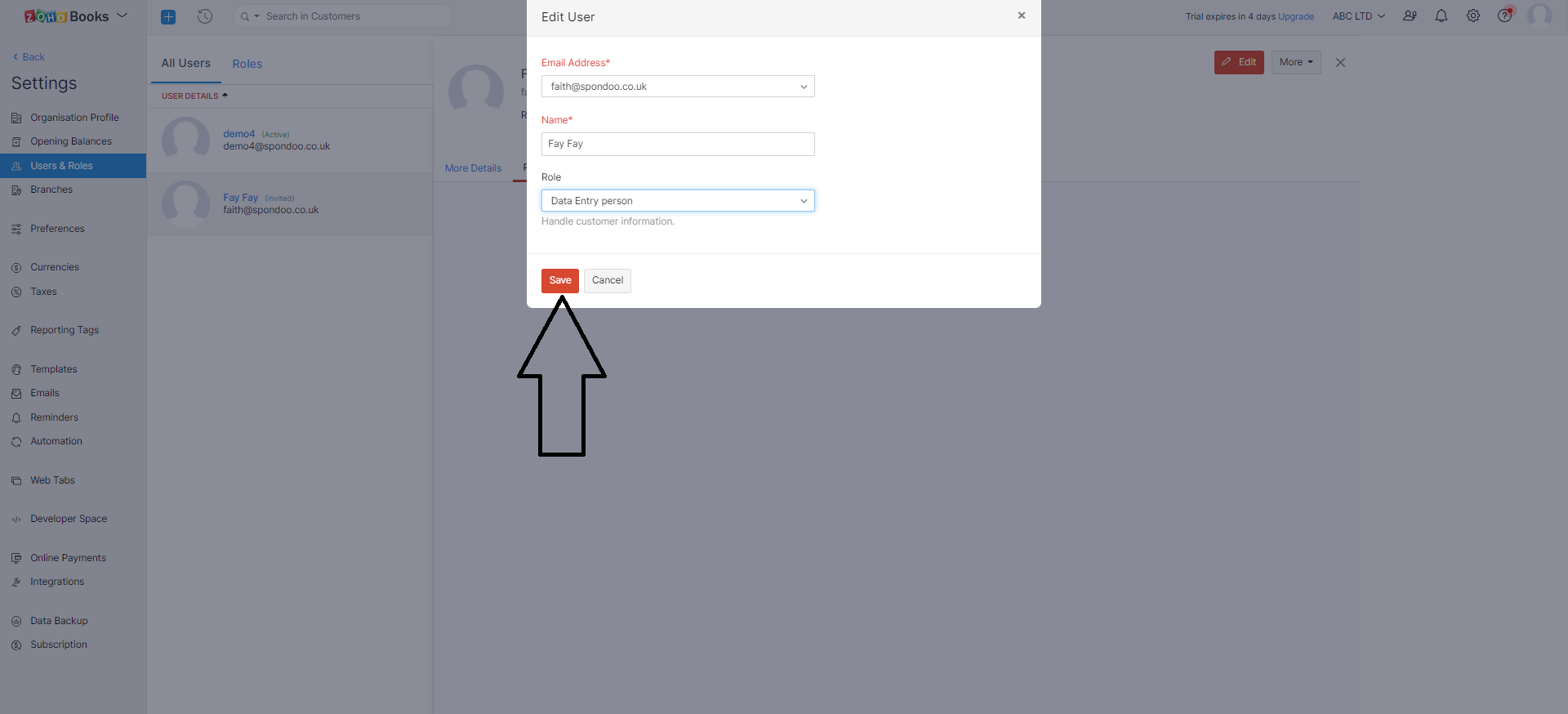

- Choose the user whose details you want to change.

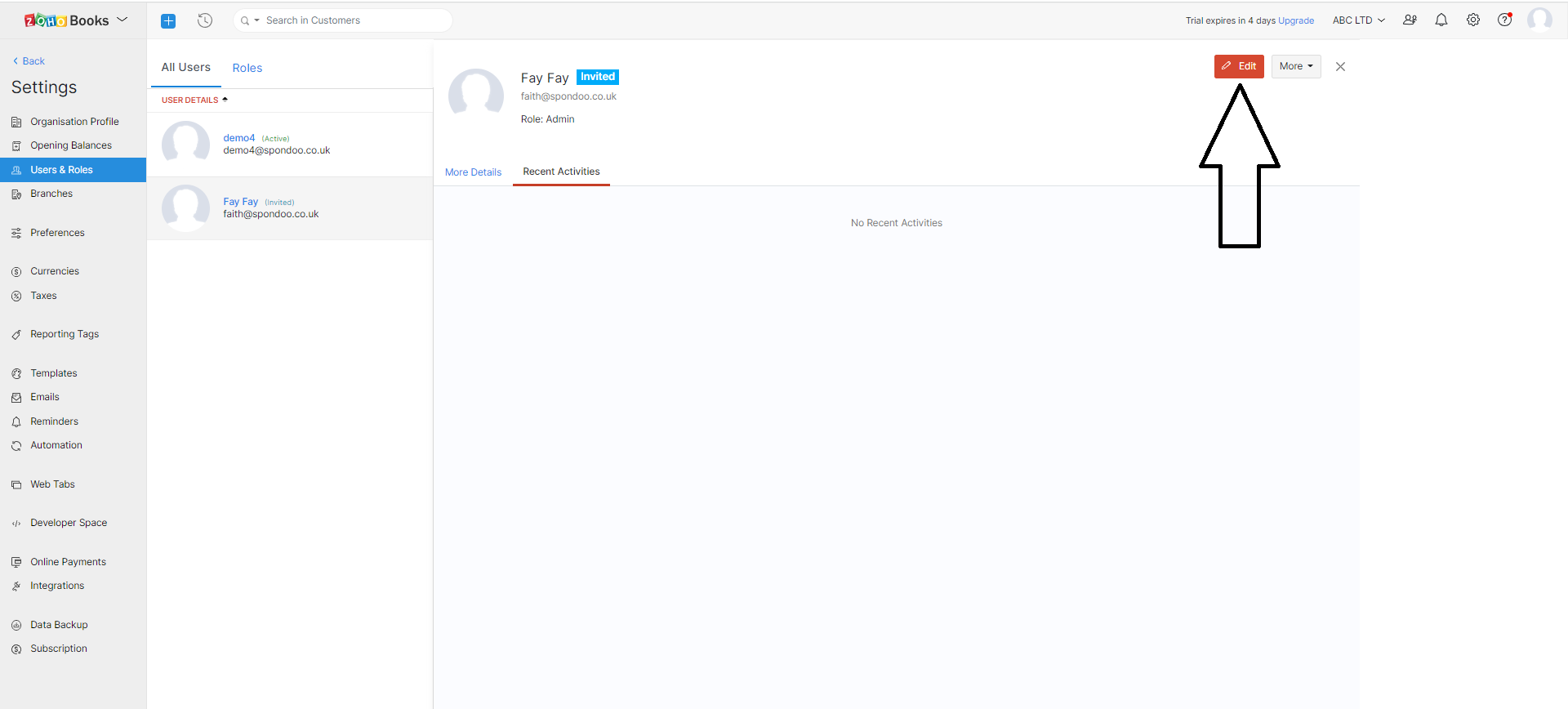

- Click Edit – a popup window will appear.

- Assign the user the new capacity from the Role drop-down menu.