Accounting.BI is a game-changing solution for businesses seeking comprehensive financial data and advanced reporting capabilities. Unlike traditional financial dashboards, Accounting.BI offers unparalleled flexibility and a wide range of features, surpassing the limitations of Futrli.

Flexibility

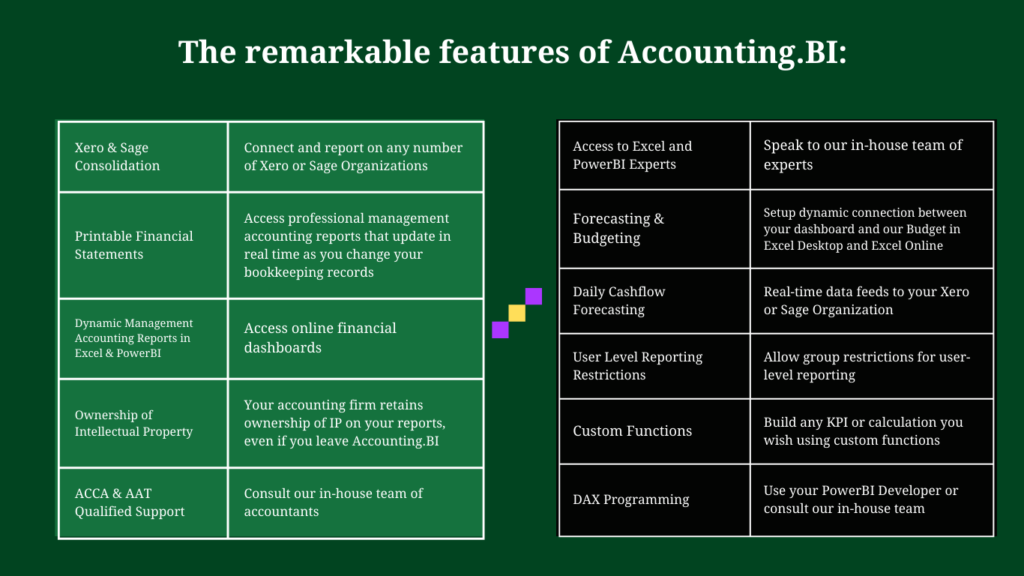

Accounting.BI offers a refreshing alternative by not being restricted to pre-built templates within your Futrli dashboard. With the ability to link to over 100 different data sources, it allows you to synchronize your Xero and Sage accounting data in real time to excel and PowerBi.

Once synchronized you can go against any number of online financial dashboards within Accounting.BI, but guess what, they are financial dashboards built within Excel or PowerBI. So, if you do not like our Accounting.BI dashboard, or need to change it yourself, you are free to do so using your own excel or PowerBI skills.

Significantly Lower Cost

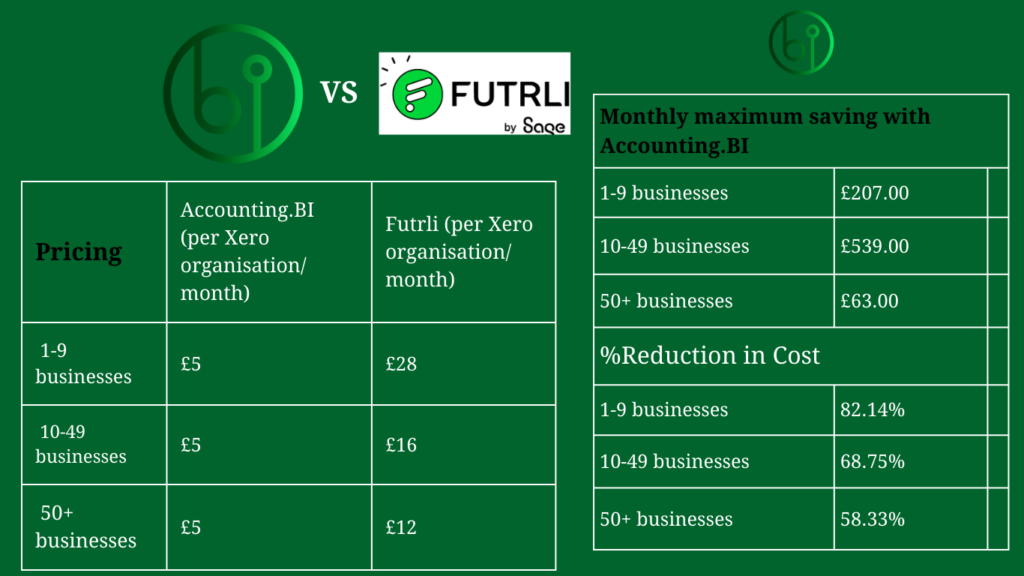

Accounting.BI allows you to enjoy significant savings of up to 82% on your monthly Futrli costs.

Let’s take a closer look at the pricing:

Accounting.BI is a comprehensive accounting business intelligence system that offers extensive features, cost savings, and unparalleled flexibility. With the ability to connect to various data sources, customise reports, and receive expert support. Our online FP&A solution empowers business owners & accounting firms to make informed decisions and provide valuable insights to their clients.

These features enhance the flexibility and customisation options available in Accounting.BI, which are not offered in Futrli.

Overall, Accounting.BI provides a more cost-effective solution with a wider range of features and customisation options compared to Futrli, making it a favorable choice for businesses in need of accounting BI tools.

Please visit our website accounting.bi to explore these remarkable features and discover how Accounting.BI can empower your business or accounting firm with valuable insights.

Don’t miss out on the more cost-effective solution with enhanced customization options that Accounting.BI provides.